A byline by Arnau Valdovinos

Is Germany’s medical cannabis boom cracking—or just recalibrating? Since the landmark CanG reform in April 2024, imports have surged fivefold, turning Germany into the world’s largest medical cannabis market. But behind the record-breaking numbers lies growing pressure: regulatory tightening, fragile supply chains, and political tension. What looked like a straight path to dominance may now hinge on how Germany navigates this emerging bottleneck.

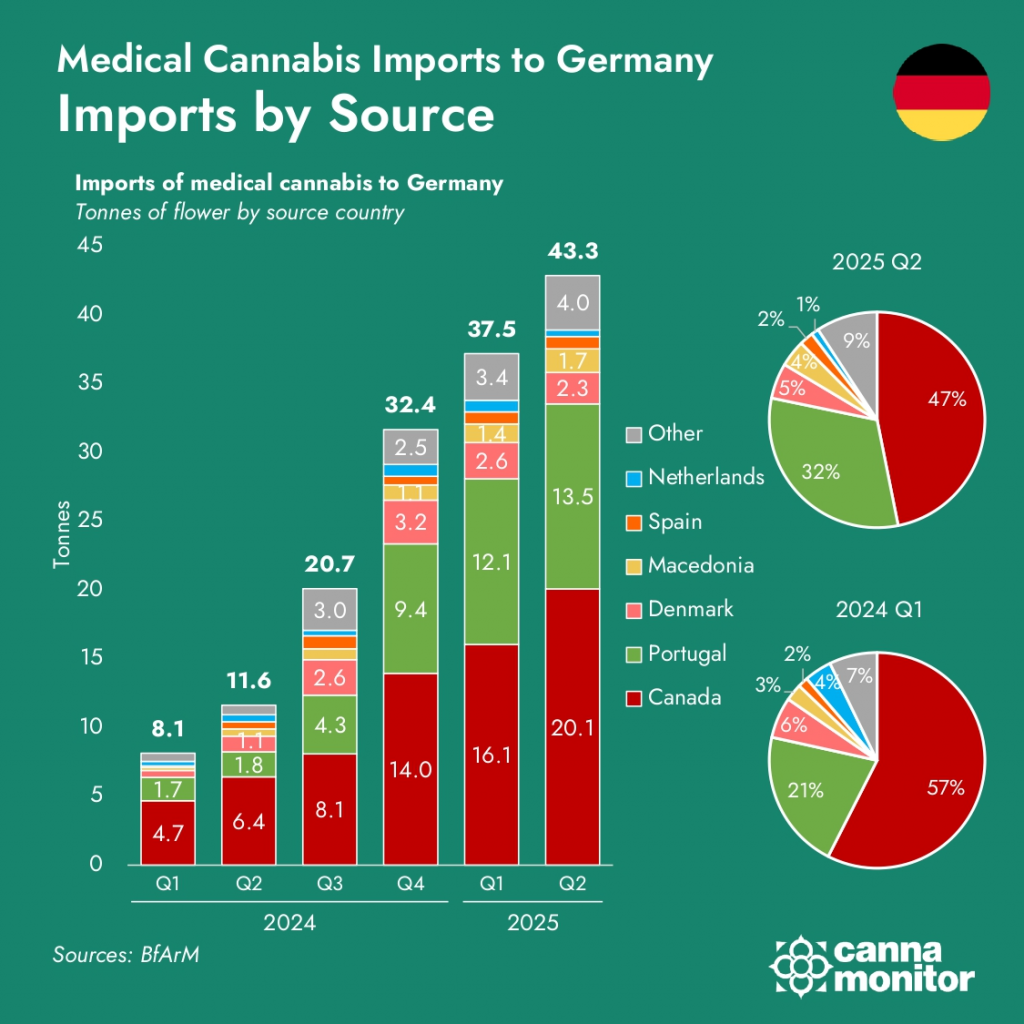

Germany has emerged as the undisputed leader of the global medical cannabis market since the landmark CanG reform in April 2024. Imports have multiplied by 5, rising from barely over 8 tonnes in Q1 2024 to 43.3 tonnes in Q2 2025. In the first half of 2025 alone, over 80 tonnes of cannabis were imported, with a trailing figure for the last year of 132 tonnes. Current projections suggest Germany could exceed 160 tonnes imported this year, and potentially surpass 200 tonnes in the coming years to fuel growing demand spurred by easy access to telemedicine prescriptions. However, this explosive growth is now encountering regulatory, logistical, and geopolitical headwinds that could signal a tightening bottleneck across the supply chain, compliance regime, and political consensus.

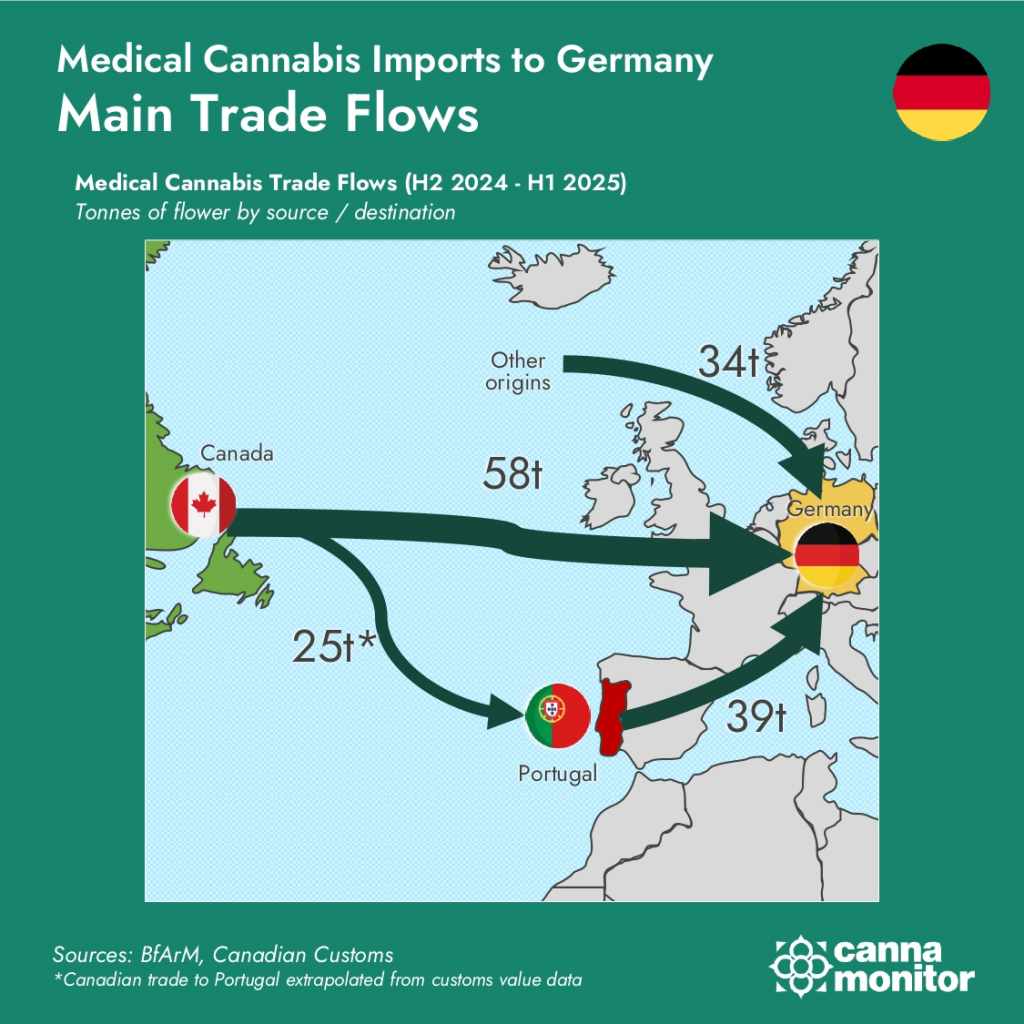

Germany’s supply chains are still dominated by the transatlantic triangle between Canada, Portugal, and Germany. Between H2 2024 and H1 2025, Canada exported 58 tonnes of medical cannabis to Germany, while Portugal contributed 39 tonnes, both of its own production as well as via processing services. Canadian Customs data suggests about 25 tonnes of Canadian product flowed through Portuguese GMP facilities to Germany. Key Portuguese processors such as Cannprisma, Blossom, MediCane, and Canapac have been instrumental in servicing this volume. However, the reliability of this channel is now under scrutiny due to compliance turmoil in the Iberian nation. Following criminal investigations and license suspensions, Portugal’s medicines agency INFARMED has increased oversight, demanding more rigorous testing and documentation, causing most players to face significant delays in their workflows, adding friction to what was once an undisputably efficient route.

<<German wholesalers are diversifying GMP partners to mitigate regulatory risk>>

These changes reflect a broader reordering of global supply chains. Canadian firms are increasingly bypassing Portugal to ship directly to Germany. Denmark, Macedonia, Spain and Czechia are also scaling their production capacity, offering alternative EU-GMP platforms. The strategic lesson is clear: redundancy is the new name of the game. Wholesalers are diversifying their GMP partners to mitigate regulatory risk and maintain delivery speed, while seeking to avoid overcomplexity that could lead to higher costs: a fine line to thread. This reflects on the structurally fragile nature of just-in-time systems in the narcotic-regulated environment of international medical cannabis trade.

Regulatory pressure is also mounting on the demand side within Germany. Federal Health Minister Nina Warken (CDU) is leading a push to restrict cannabis prescriptions via telemedicine, ban mail-order deliveries, and reintroduce in-person consultations. The ABDA supports these reforms, demanding that cannabis flowers face tighter price regulation and exclusion from standard reimbursement pathways. Health insurers are openly considering stopping reimbursements for cannabis flower altogether. The SPD and most industry players oppose the move, warning that it could drive patients back to the black market: a survey by MedCanOneStop found that 92.6% of patients fear recriminalisation, and 59.2% would switch to illicit sources if digital access were blocked. However, the CDU-SPD coalition is dependent on fragile parliamentary alliances and likely lacks the political consensus to enforce a full rollback. But uncertainty alone is reshaping business models.

The tension between supply and demand is playing out through pricing dynamics. For years, global cannabis pricing was dominated by oversupply and price collapse. This narrative shifted after the demand boom following April 2024. Three new forces counteract the scenario of price compression and might promote higher wholesale prices: boom-bust investment cycles, product segmentation, and supply chain shocks. Germany, though still early in the maturity curve, is beginning to stratify: budget products are gaining share, but premium SKUs, differentiated by cannabinoid profile, format or brand, are defending margins. However, the growth of the budget segment reflects real patient demands and is unlikely to go away despite the supply chain bottlenecks. In fact, old produce stuck in Portuguese warehouses might want to be sold at a discount to increase sales velocity.

The Remexian–High Tide acquisition must be understood in this context. High Tide’s €27M acquisition of 51% of Remexian—Germany’s fastest-growing cannabis distributor—marks a strategic realignment. Remexian built its dominance on Portuguese budget flower, expanding to over 200 SKUs and distributing nearly 2.5 tonnes per month, with a commanding 15% market share. But Portuguese compliance challenges flipped the script. Investigations into Portuguese LPs and distribution disputes over irradiated product registration have triggered a boycott from operators like Sanity Group and Cansativa. High Tide’s acquisition signals a pivot toward Canadian sourcing, potentially reducing reliance on Iberian throughput.

At the centre of this emerging bottleneck is a little-publicised development: BfArM has reached its INCB quota for 2025. According to a recent investigation by krautinvest.de, Germany’s current annual demand estimate of 122 tonnes for medical cannabis flowers, as reported to the International Narcotics Control Board (INCB), has already been exhausted. As a result, no further import permits can currently be issued. BfArM confirmed that there is no formal ban, and that imports will resume once the so-called „re-estimation“ is accepted by the INCB. However, the process remains opaque and may introduce weeks—if not months—of delays. This could affect forward contracts, market planning, and inventory levels for distributors.

The significance of this bottleneck extends beyond administrative delays. It exposes the tension between Germany’s domestic medical boom and the international treaty frameworks that govern narcotics. Deepak Anand rightly pointed out that while the INCB does not impose hard limits, countries must justify overages or face future quota reductions. BfArM is caught between a booming patient population—up nearly 300% in the past year—and the conservative logic of international drug control systems.

Even as bottlenecks tighten, the German market continues to expand. Telemedicine has enabled unprecedented access, particularly in rural areas, and pharmacy coverage remains patchy, with several federal states lacking a single cannabis-specialist pharmacy. Mail-order services like Grünhorn or LUX99, now under threat, have been vital to equitable access.

The situation is increasingly paradoxical. Imports are paused due to INCB quota limits, but demand is soaring. Compliance requirements are escalating, but innovation in product formulation and delivery formats –such as rosin, vapes, edibles or prerolls– is accelerating. Political resistance to cannabis liberalisation is hardening in the CDU, while commercial actors expand their footprints, attract foreign capital, and prepare for long-term growth. Germany is simultaneously tightening and growing.

This contradictory moment may define the future of medical cannabis in Europe. Germany has become the gravitational centre of the global cannabis trade, but with that role comes exposure to all its tensions: between patient rights and regulatory compliance, between national policy and international treaties, and between supply efficiency and strategic redundancy. The current bottleneck will prove to be a temporary brake or perhaps the start of a new regime.

About the Author

As the founder and principal consultant of Cannamonitor, Arnau Valdovinos (Linkedin) connects the dots of the global supply chain through an independent view of the international cannabis markets. An advocate for evidence-based drug policy reform, since 2018 Arnau has provided intelligence and practical advice to medicinal, recreational and CBD companies across 5 continents and 20 countries.

Disclaimer: Guest contributions do not have to reflect the opinion of the editorial team.